If you rent, it's always a good idea to get renters' insurance, even if your landlord doesn't require it! For a price that is easy on the wallet, renter's insurance will protect you against catastrophic damage to your property and possible legal problems. When you rent an apartment, unit, or house, your landlord is responsible for insuring the building, making any needed structural repairs, and paying for any injuries that directly result from problems with the building itself. But renters can also help protect their home by getting their own policy.

If you're wondering whether or not purchasing renter's insurance might be a good idea, keep reading. There are still considerations to make when selecting a provider, even if doing so is mandatory by your landlord. It's also a good idea to compare prices from multiple providers. This will help you make a decision and find a policy that works best for you. (That’s where we come in)

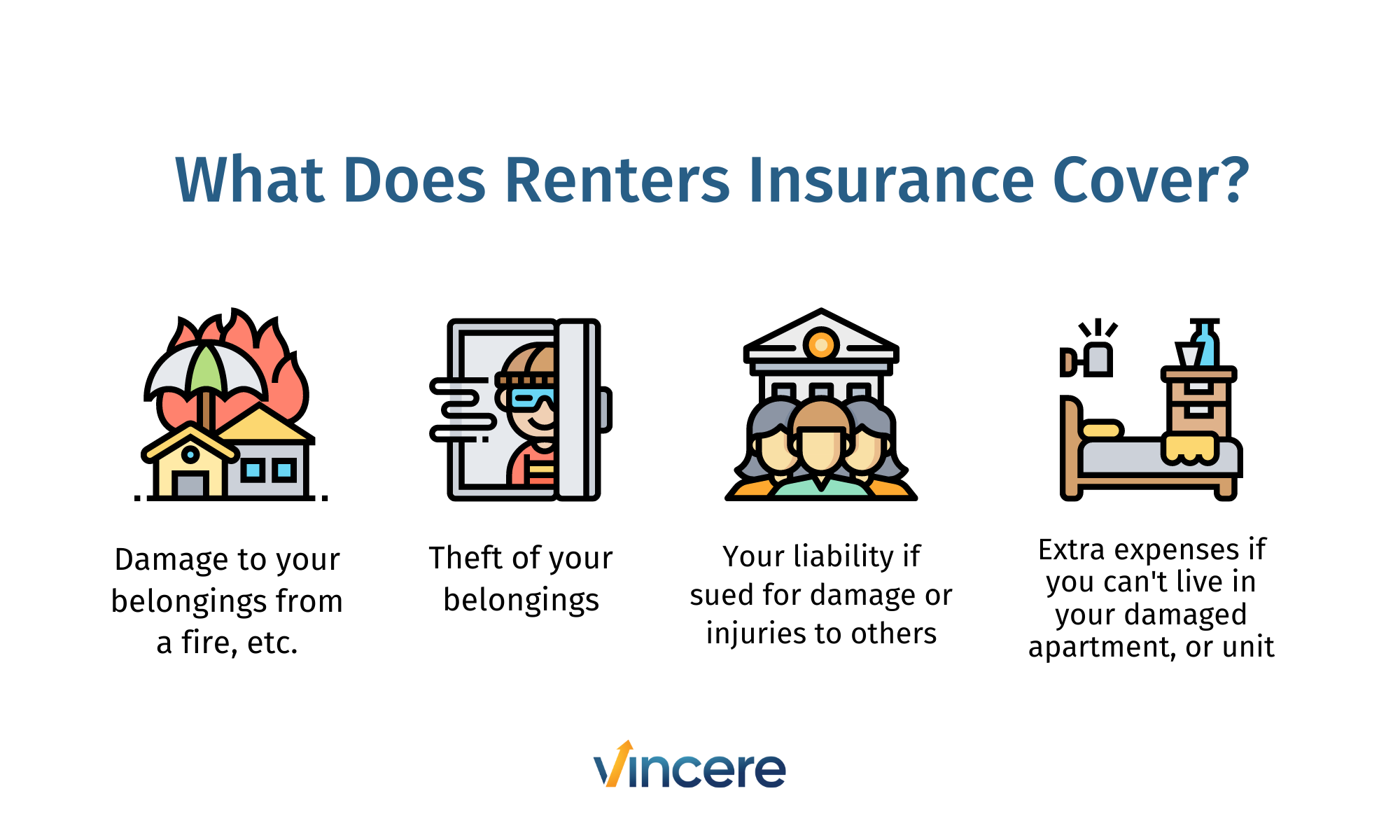

Renters' insurance is similar to homeowners' insurance, but it doesn't cover the building or structure since that's covered by the landlord's policy. It's meant to protect the renter from having to pay a lot of money out of pocket if something unexpected happens, like a fire or a robbery..

The majority of renters' insurance policies cover the cost of replacing your personal items, the loss of use of your house and your daily routine if you must relocate, and your liability if you are liable for another person's accident in your home. When an unplanned covered event occurs, you file a claim with your provider and begin receiving the benefits as agreed.

There are three basic categories of incidents that are covered by renters' insurance coverage. Any loss or expense in these categories caused by a covered incident will be compensated up to a set limit. If you want additional coverage alternatives, most insurance carriers provide add-ons called endorsements that are ideal for renters seeking additional peace of mind.

Personal Property: This is the most important category for many people, since it provides renters with the peace of mind that their items will be replaced in the event of a covered unforeseen event. When choosing a policy, you usually have two options: actual cash value (ACV) and replacement cash value (RCV). ACV insurance is often more affordable because it only covers the depreciated value of your belongings.

Liability: This coverage compensates for fees that may arise if you are held liable for someone's injury on your property. If necessary, liability insurance will cover both medical expenses and legal fees. Even if you are not at fault, some plans will cover medical expenses for injuries that occur in your home.

Loss of Use: This coverage reimburses you for any additional expenses incurred as a result of a covered incident. For example, if you are displaced from your home and need to pay for a hotel room and additional meals, your renters' insurance will cover those expenses.

Renters insurance covers your furniture, clothes, jewelry, electronics, and even small items like knickknacks if they were stolen or damaged by a problem listed in your policy. Your renters insurance will cover personal items in your car, like things that are stolen from your car.

Your personal property is only covered up to the limit of your policy, and some items may not be covered at all. Here are some examples of special limits in a typical renters insurance policy:

- Limit of $200 for money, bank notes, gift cards and related items.

- Limit of $1,500 for jewelry and watches that are stolen.

- Limit of $2,500 for silverware, goldware, platinum-ware and related items that are stolen.

- Limit of $2,500 for items used for business purposes.

Check your renter's insurance to see if there are any special limits. If you have expensive jewelry or art, you can put it on a separate list of personal property. This lets you fully cover items that are more expensive than what your renters policy covers.

Personal liability coverage in a renters insurance policy protects you financially if you are sued for causing or damaging someone else's property or body.

These things could be:

- Having a guest slip and fall in your place

- Even at the park, if your dog bites someone,

- Your bathtub overflowing and damaging the unit below it.

Liability insurance also pays for your legal defense and can cover any damages if the court decides you were careless. It's a good idea to get enough personal liability insurance to cover what you could lose in a lawsuit.

If an incident or event that is covered by your renters insurance makes your home unlivable, additional living expenses coverage will pay for the cost of living somewhere else until you can move back in.

Up to the limits of your policy, additional living expenses coverage can help pay for things like hotel stays, meals, pet boarding, and other costs that come up when you have to move.

This coverage is also called "loss of use" coverage.

You can choose between actual cash value (ACV) and replacement cost coverage when you buy renters insurance. Replacement cost coverage costs more, but it's better because it doesn't take into account how much something has lost in value.

- ACV will pay the TV's depreciated value if it is damaged in a fire today.

- Replacement cost coverage will pay for a new TV that is similar to the one that was broken at today's prices.

- Accidental discharge or overflow of water or steam

- Aircraft

- Explosion

- Falling objects

- Fire or lightning

- Freezing

- Riots

- Smoke

- Sudden and accidental damage due to short circuiting

- Sudden and accidental tearing, cracking, burning, or bulging

- Theft

- Vandalism

- Vehicles

- Volcanic Eruption

- Weight of ice, snow, or sleet

- Windstorm or hail

- Flood

- Earthquake

- Damage from pets

- Personal injuries

- Damage from pests

- Car damage

- Sinkholes

- Terrorism

Some of the above-listed events that aren't covered by a basic policy can be added as an endorsement for an extra cost. When getting quotes from several companies, you should examine the extras they offer and consider what you might wish to include.

You can file a claim if you have a problem covered by your renters insurance coverage, such as a fire or theft. Here are some important things to keep in mind.

1. Collect as much information as possible after an incident, including photographs and videos of the damage.

2. Include a copy of the police record when making a claim due to theft or vandalism. The greater the specificity, the better, as it will serve to support your case.

3. If your renters insurance coverage covers the loss or damage, you will receive a payment for the amount of your loss, less your deductible.

A renters insurance deductible is the amount that will be deducted from your insurance company's claim payment. For example, if your deductible is $250 and your claim is $1,000, the insurance company will pay you a check for $750 ($1,000 minus $250 = $750).

The greater the deductible, the cheaper the cost of your renter's insurance, and vice versa.

Renters insurance is a worthwhile investment because it inexpensively protects against unforeseen catastrophes. With a renters insurance policy, you pay a reasonable fee now — on average, $100- $150 per year — to protect yourself from large and unpredictable future costs.

The advantages of renter's insurance stem from its extensive coverage, which protects you against the following:

1. Damage to personal property: The average renter's belongings are worth between $20,000 and $30,000. This is according to several large insurance companies. If your personal property is stolen or damaged by a covered peril, like a fire, renters insurance will cover the loss up to the limits you choose.

2. Personal liability: Renters insurance covers the costs if you are found to be responsible for someone getting hurt or damaging someone else's property.

3. Additional living costs: If your rental house or apartment can't be lived in because of something covered by the policy, a renters insurance policy will pay for costs above and beyond your normal living costs. This makes sure that your budget stays the same even if you have to live somewhere else for a while.

4. Medical costs: This feature pays for your guests' medical bills if they get hurt on your property, usually up to a few thousand dollars.

All of these features give you coverage that is worth a lot more than the amount you pay each year for a policy.

For example: A typical renters insurance policy will cover damage to your personal property up to $30,000 and liability costs up to $100,000. You can change these limits to fit your needs. So, the amount of coverage you have is much higher than the average cost of renters insurance, which is about $215 per year.

Regardless of your ability to pay unexpected costs, renters insurance is a good idea. If you have limited funds, you'll need renters insurance to offset the risk of disasters. Even if you have the money to self-insure and fully cover disasters, the cost of renters insurance is minimal in relation to the amount a policy would cover for property repair, property replacement, and liability payments in the event of a significant disaster.

Even if you have enough money to replace all of your items or fulfill legal obligations, renters insurance is still a good idea. A renters insurance claim will cover damages that greatly surpass your premium, even if you've had the policy for years.

Alternatively, suppose you pay $200 per year for a renters insurance policy with $100,000 in legal liability coverage. The $100,000 limit will cover your dog bite liabilities!

Some may say that by purchasing renters insurance, you're paying for a service you'll rarely use. Obviously, this is technically accurate. If you pay for a renters insurance policy year after year and a tragedy never strikes, you will not get any benefits.

However, if you do need to submit a claim, renters insurance will cover you for property damage and legal liability far beyond the amount of your monthly, more than compensating for the premium payments you have made over the years.

For instance: in the aforementioned dog bite example, you would have to pay $200 per year for 175 years for the cost of your insurance to equal the average payment for a dog bite claim, $35,000. And this is only one example. During the duration of their tenancy, tenants may incur a range of unplanned property damage charges and obligations.

1. Always shop around for your renters insurance policy

2. Pick appropriate coverage limits

3. Adjust your renters insurance deductible

4. Take advantage of renters insurance discounts

5. Consult with a financial advisor

If you’re on the fence about renters insurance, it’s time to climb down. If you rent, it's always a worthwhile investment to get renters insurance, even if your landlord doesn't require it. For a low price, renters insurance will protect you from catastrophic damage to your property and possible legal problems.

And renters insurance covers a lot more than just the things you own. It also provides liability insurance, temporary living expenses and more. All of this for maybe $10 a month. That is a win-win situation. Wouldn’t you agree?

As a Partner and Financial Advisor here at Vincere Wealth, Tim helps clients navigate their financial challenges and decisions. Having someone guide you today in making sound financial decisions can have a substantial impact on your future financial well-being. Tim takes great pride in guiding clients through the complexities of insurance, estate planning, and cash flow optimization.

If you’re on the fence about renters insurance, it’s time to 🧗♀️ climb down. Renters insurance is always a worthwhile investment, even if your landlord doesn't demand it. It protects you against property damage and legal problems for a low price. Plus other benefits! Continue reading to learn more.

If you’re on the fence about renters insurance, it’s time to 🧗♀️ climb down. Renters insurance is always a worthwhile investment, even if your landlord doesn't demand it. It protects you against property damage and legal problems for a low price. Plus other benefits! Continue reading to learn more.

If you’re on the fence about renters insurance, it’s time to 🧗♀️ climb down. Renters insurance is always a worthwhile investment, even if your landlord doesn't demand it. It protects you against property damage and legal problems for a low price. Plus other benefits! Continue reading to learn more.